Not sure if your super’s doing enough?

Most Australians never picked their super fund. That silent choice could be costing you years of freedom.

Get a personalised retirement plan for free - built around your goals, not just your fund.

✅ Designed for Aussies 40+

✅ Takes 2 minutes to get started

✅ No jargon, no pressure - just clarity

![]()

![]()

Not sure if your super’s doing enough?

Most Australians never picked their super fund - and that quiet default could be costing you years of freedom.

Take our 2-minute quiz to get clear on where you stand - and what smart changes could help you retire sooner, with more.

✅ A simple breakdown of where you're at

✅ Clarity on what could be holding you back

✅ See if you qualify for a custom super plan from a licensed financial advisor

The #1 Thing People Say After Calling Us

What You Don’t Know About Your Super Could Be Costing You Years of Freedom

Most Australians don’t realise their super fund isn’t keeping up - until it’s too late.

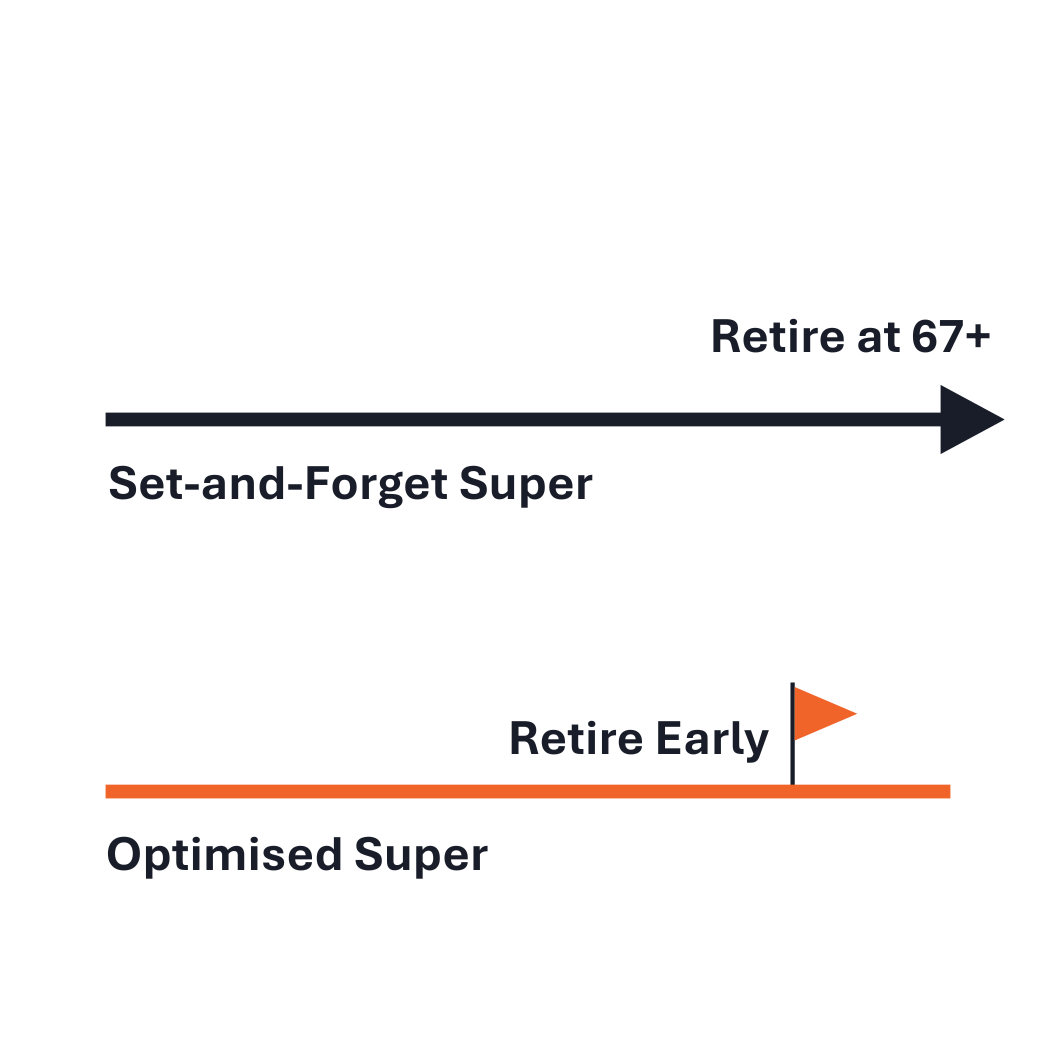

They stick with what was chosen for them decades ago. No major fees. No red flags. Just slow, quiet underperformance year after year.

They assume they’ll retire at 65. They assume working longer will fix the gap. But the truth is:

- Many Aussies are unknowingly tens (often hundreds) of thousands behind where they could be.

- Even high earners can lose years of freedom by not reviewing their setup.

- That “set-and-forget” mentality can drain your options, income, and freedom.

The lesson? Staying where you are might feel safe. But it’s usually the costliest move of all.

We see it all the time. But it doesn’t have to be your story.

![]()

Working with Scott has been great, in just under 5 years, he’s helped boost my super by over $150,000 more than it would have been had I stayed with my industry fund.

Wealthlab client - 5 years

Get a Super Plan That’s Actually Built For YOU

|

Industry Fund |

WealthLab |

|

|

Advice |

Generic, one-size-fits-most |

Tailored to your goals, lifestyle & timeline |

|

Support |

Yearly statements |

Ongoing strategy, clear next steps |

|

Service |

Call centre reps |

A dedicated, licensed advisor who knows you and answers when you call. |

|

Fees |

Unclear |

100% transparent |

|

Clarity |

Hard to understand, full of jargon |

Everything is explained in plain English. If you don’t understand something, we talk it through until you do. |

|

Outcome |

“Hope it’s enough” |

Get clear on where you stand - and what it’ll take to retire sooner, with more in your pocket and less stress along the way. |

Tell us where you’re at

Take our 2-min quiz so we understand your setup and if we can help.

Talk to a licensed advisor (not a bot)

If you qualify, a licensed advisor will review your current situation in depth and build a custom plan based on your age, income and retirement goals.

Get your personalised plan

We’ll show you exactly what’s working, what’s not, and what you could do to get ahead so you can retire on your terms.

![]()

Meeting and forming a relationship with Phil has been the best thing I have done in a year. Like a lot of people my age, having advice from an expert was something I will 'get to one day', well I’m glad I did and wish I had earlier.

Is this really free?

Yes, if you qualify, your personalised review and plan are completely free. It’s our way of giving you real value upfront and showing you how we work. If you choose to work with us beyond that, we offer paid services, but only if it’s a good fit.

Do I need to move my super to work with you?

Not always - we'll help you assess if that's even necessary.

I’m not great with numbers - will I understand this?

Yes. We explain everything in plain English. We're not here to impress you with fancy graphs (although we’re good at those too). Our goal is help you understand exactly what your money’s doing, and how to make it work harder for you.

Is it too late to make a difference?

It’s true that many people leave it longer than they should - but that doesn’t mean it’s game over. Even small changes now can make a big difference later. The worst move is doing nothing.

I’ve seen how hard retirement can be on the pension. Can I avoid that?

Yes - and that’s exactly why we do what we do. Many clients come to us after watching loved ones struggle on a government pension. We help you avoid that path by building a personalised strategy focused on freedom, flexibility, and peace of mind.

I don’t feel confident talking about money. Will I be judged?

Never. You don’t need confidence - just curiosity. We’re here to explain things clearly, answer your questions, and support you without judgment.

What if I’m earning well - doesn’t that mean I’m on track?

Not always. Even high earners can fall behind if their super isn’t actively managed. With the cost of living rising, most couples need over $80K a year to retire comfortably, and that number keeps growing. Without regular check-ins and a clear plan, it’s easy to miss key opportunities that could boost your balance and bring retirement forward. The truth? Earning well helps, but optimising your super is what makes the real difference.

Do I have to wait until I'm 65 to retire?

No. Just because super is designed for 65+ doesn’t mean you need to wait. Many of our clients assumed they’d retire at 65 - until we showed them how to do it sooner, and stronger. Your timeline should fit your life, not someone else’s rulebook.

Do I need millions to get good financial advice?

Not at all. Most of our clients are teachers, tradies, business owners - people in their 40s, 50s or 60s who just want to retire comfortably and live on their own terms. Some feel behind. Some are starting over. All of them want a better plan.

Is this right for me?

This might be a great fit if you:

✔️ Are in your 40s, 50s or 60s - and not sure if your super is doing enough

✔️ Working hard, earning well, but feel like you could be doing more

✔️ Wondering if you can retire earlier (and better) than you’ve been told

✔️ Sick of confusing advice, hidden fees, or feeling left in the dark

✔️ Starting over after a major life change (like divorce or career reset)